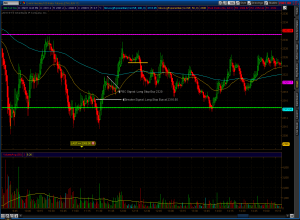

We consider every pullup in price as an opportunity to enter short.

Break of 2283.50 would signal a potential trend reversal, long bias. But a break to the downside (after the 2283.50 break) of a critical level on our smaller charts will signal a continuation to the downside, with the break above 2283.50 being a false signal.