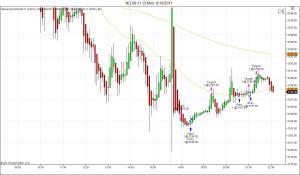

We had 4 signals so far since 6 PM EST. I would like to explain each signal and discuss what we did and why we did it.

1) Short 2184.25: 2183.25 had massive support from buyers and sellers were not able to breach that level. We moved our stop to the invalidation point which was 2184.00. We got 1 tick of slippage an were stopped out at entry on this, resulting in $0 on the trade.

2) Long 2184.00: We saw the massive support in the market / initial wave of buyers come in. We got stopped out on trade 1 and entered long due to the support from buyers and pressure to the upside. Our stop was placed at 2183.00. We took profit at 2187.75 once we saw buying pressure fade / sellers resisting price. Since we had a long bias and were expecting a pullback rather than a reversal, we disregarded the short signal. Profit of $75

3) Long 2187.50: We bought the pullback once we received a long signal, stop placed below the swing low. We realized the market was somewhat choppy / ranging so we decided to take a profit on this trade of 2 ticks and then re-enter with our stop placed at the same invalidation point of 2187.00, see below. Profit of $10.

4) Long 2187.50: We re-entered the long direction as mentioned above. Our situation now is completely risk-free since we secured the 2 ticks and are now risking 2 ticks. We exited when buying pressure seemed to fizzle out. Profit of $50.

Entering on the signals given, we have a profit of $135 so far.