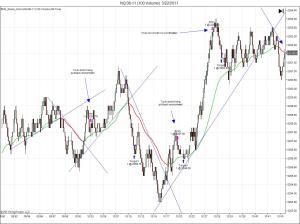

Here is a chart showing our entry prices and the targets that were hit. The first trade was taken short during an uptrend signal, making us take more heat than we normally like to; we eventually filled our target though since our full stop was not hit. The second trade was just pure luck. A short was taken at the top of a higher high (uptrend signal) and we got the target filled at the pullback point. The third trade was because of pure speculation of over extension, which is what we attempt to never do, so the fact that the trade worked out is lucky since we shorted with no short signal yet present. At the far right of the chart, we had a break of trend with potentially a lower high being form, which it did, and a short signal triggered on that pullup in price.

First quarter earning are on deck for traders, so the volume is extremely light in the markets currently; until some figures start coming out. Our primary issue today was lack of clear signals, lack of volume, and trading in an environment with weak signals. We ended the day with a small profit, hopefully we can apply our observations from today's tight market environment into the future.

No comments:

Post a Comment